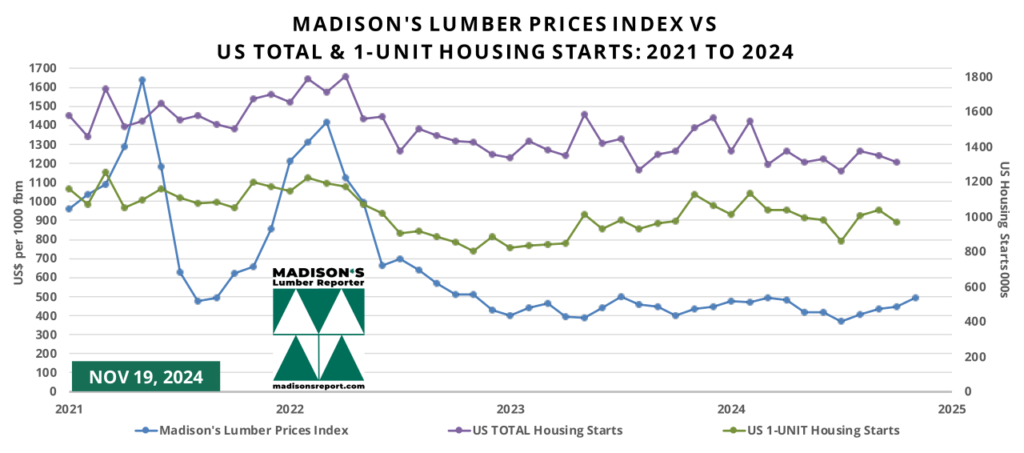

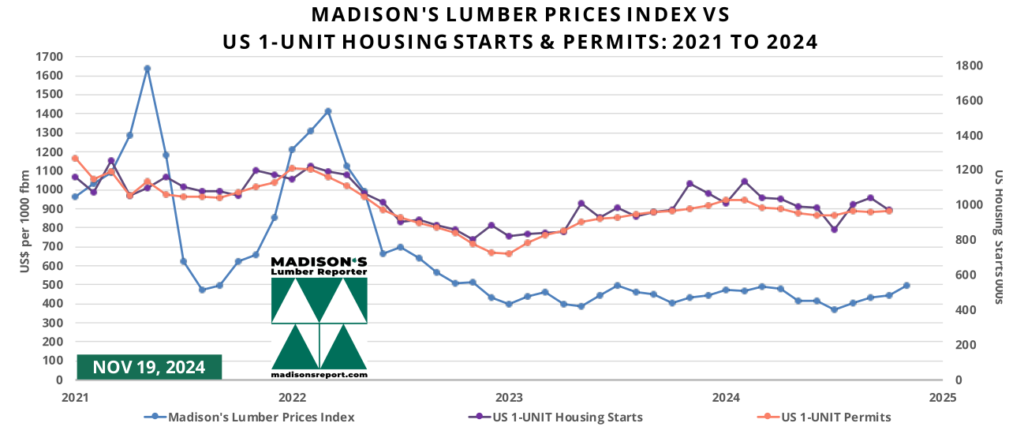

Single-family starts in the US dropped in October likely as Hurricanes Helene and Milton depressed activity in the South. Meanwhile, permits rose slightly, indicating that an anticipated rebound probably would be muted by higher mortgage rates.

The Madison’s Lumber Prices Index for the week ending November 15, 2024 was US$495 mfbm. This is up +3%, or +$14, from the previous week when it was US$481. This is up +11%, or +$50, from one month ago when it was US$445.

For information regarding the construction of this Index (species mix, weighed averages) please go here: https://madisonsreport.com/madisons-lumber-prices-index-a-powerful-tool-for-data-driven-decision-making/

Total US housing starts in October were 1.31 million units, down -3% from the revised 1.36 million units in September, and down -4% from October 2023 when it was 1.37 million units.

A forward-looking measure of housing construction, total building permits were almost flat month over month at 1.42 million units, from 1.43 million in September, and fell almost -8% compared to October 2023 when it was 1.53 million units. The number of houses approved for construction that were yet to be started increased +1% to 279,000 units.

The single-family homebuilding backlog was flat at 143,000 units.

Single-family housing starts, which account for the bulk of homebuilding, in October fell almost -7% compared to September, at a seasonally adjusted annual rate of 970,000 units, from 1.0 million units. The inventory of single-family housing under construction was unchanged at a rate of 644,000 units. Single-family permits were also almost flat from September’s 963,000 units, to a rate of 968,000 units in October.

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales.

Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

Madison’s Benchmark Softwood Lumber Prices: november 2024 Compared to Historical Highs and Lows

“Relatively high inventory of new homes for sale suggests that single-family construction probably will flatline at best over the coming months, and could easily start falling back again soon if mortgage rates remain around their current levels,” said Oliver Allen, senior US economist at Pantheon Macroeconomics.

New single-family construction has regained ground after taking a beating from a resurgence in mortgage rates during the spring. Momentum, however, has been restricted by new housing supply at levels last seen in 2008, hurricanes in the US Southeast, as well as still-elevated borrowing costs.

Though new housing supply has risen, previously owned homes on the market, especially entry-level properties, remain in short supply. Most homeowners have mortgage rates below 4%, reducing the incentive to move.

It is important to note that housing completions are actually up +17% this October compared to 2023.

The completions rate for that single-family housing decreased more than -1% from September to 986,000 units in September. Overall housing completions dropped -4% to a rate of 1.61 million units.

Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

Madison’s Lumber Reporter Weekly Summary: november 15, 2024

Framing Lumber:

The frenzied tone of lumber sales attenuated in most product categories. Supply remained tight as a drum and prices were firm or up.

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

KEY LUMBER PRICES AND MARKET CONDITIONS TAKE-AWAYS:

- Producer order files were extended to early-December.

- Demand weakened slowly, but was still well-ahead of scanty supply.

- Sawmills felt no urge to be aggressive, and buyers were content to sit on the sidelines.

- Sales lead times were in the three- to five-week range.

- Positive moves in lumber futures underscored the buoyant tone in business.

- Southern Pine prices continued to correct after rising higher than the market could bear.

- SYP suppliers without on-ground inventory had to entertain significant counteroffers.

Madison’s Lumber Prices Index november & US Single-family Starts, Permits october: 2024

Looking at lumber prices, in the week ending November 15, 2024 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$460 mfbm. That week’s price is up +$16, or +4%, from one month ago when it was $444, according to the latest data from Madison’s Lumber Reporter.

That week’s price is up +$57, or +14%, from one month ago when it was $403.

Madison’s Western S-P-F 2×4 Lumber Prices: July 2024

As for those lumber prices, compared to the same week last year, when it was US$404 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending November 15, 2024 was up +$56, or +14%. Compared to two years ago when it was $490, that week’s price is down -$30, or -6%.