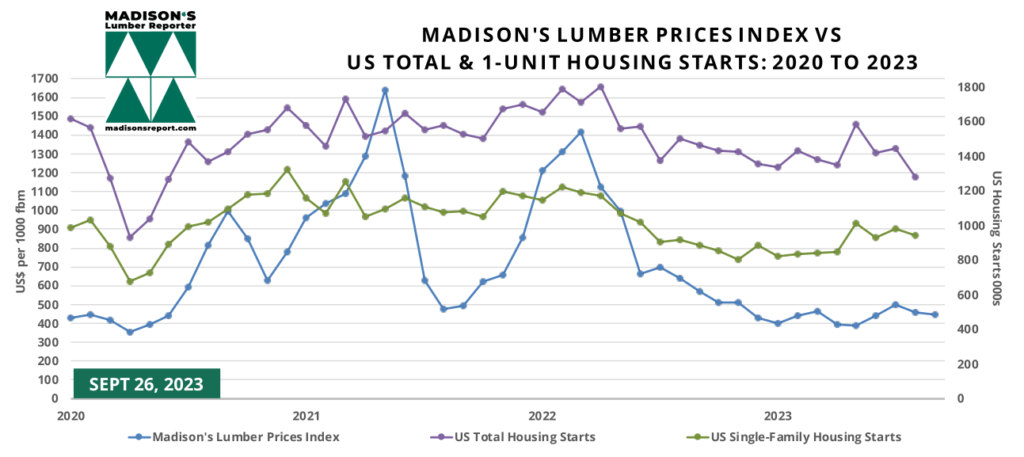

After spiking to unsustainable highs during the disruptions to society in the past couple of years, US housing starts trended further downward in August 2023. Permits for authorizations of new home building increased, however.

Demand for new construction has been boosted by an ongoing acute shortage of previously owned homes on the market. Realtors estimate that housing starts and completion rates need to be in a range of 1.5 million to 1.6 million units per month to bridge this inventory gap. Expectations among construction industry insiders and financial lenders alike is that single-family construction starts could rebound in the coming months, if builders are able to keep their skilled labour.

Coming off real highs in the previous two years, August total housing starts in the US fell by -11% from the

previous month, to 1.283 million units, compared to the 1.447 million units reported for July 2023, and were down -15% from the August 2022 rate of 1.505 million units.

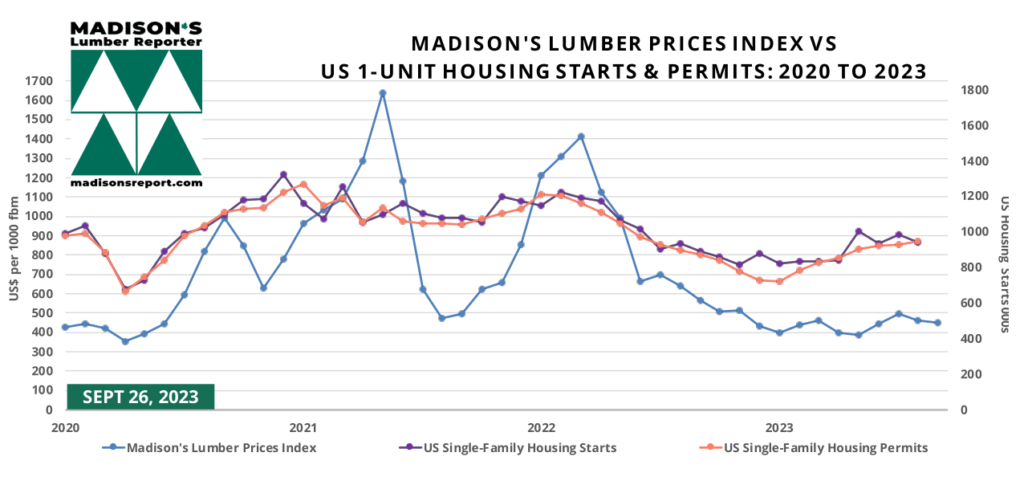

Building permits meanwhile, as an indicator of construction activity to come, continued a recent rising trend to increase by almost +7%, at 1.543 million units, from the July rate of 1.443 million. This is -3% below the August 2022 rate of 1.586 million. These permits will eventually become starts and will help to underpin residential construction.

Madison’s Lumber Prices Index Sept & US Housing Permits Aug: 2023

Meanwhile, the Madison’s Lumber Prices Index for the week ending September 22, 2023 was US$448 mfbm. This is down by -1%, or -$4, from the previous week when it was US$452.

Beginning to normalize after unusual highs, housing completions rose by more than +5% from July, to an estimated annual rate of 1.406 million housing units. Units under construction remained high compared to historical averages, at 1.688 million units. Of those, 676,000 were single-family homes.

August starts of single-family housing, the largest share of the market and construction method which uses the most wood, dropped slightly, down by -4% to a rate of 941,000 units, from July’s 983,000 units.

Single-family authorizations were at 949,000 units, which is +2% above the July figure of 930,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of July construction activity.

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales. Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

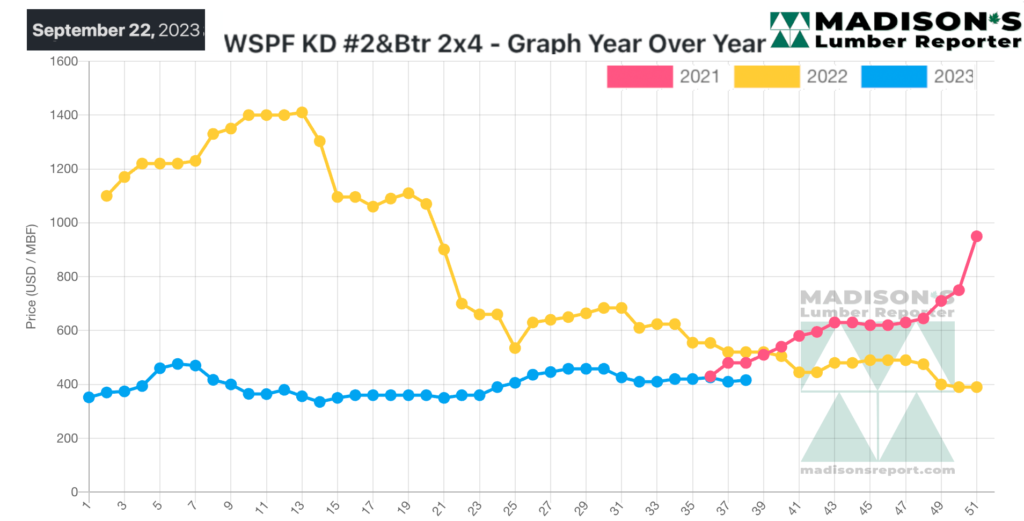

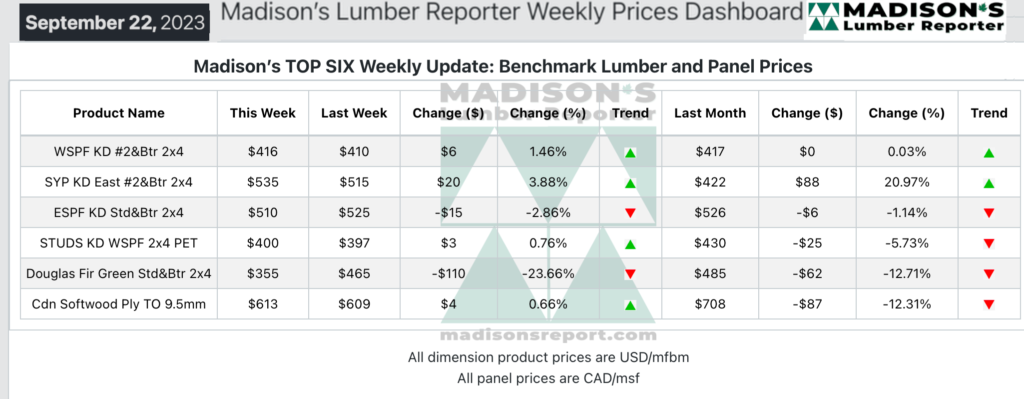

Looking at lumber prices, in the week ending September 22, 2023, the price of benchmark softwood lumber commodity Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$416 mfbm, which is up by +$6, or +1%, compared to the previous week when it was $410, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is almost flat compared to one month ago when it was $417.

Tenacious traders of Western S-P-F dimension lumber in the United States found pockets of amenable activity despite the cautious tone among buyers. Sawmills continued to work within a narrow price range, turning away customers who requested steep discounts.

Positive housing permit news gave solid wood producers confidence regarding potential upcoming business. Players thought it was a good time for end-users to cover needs into October and maybe even November.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Historical Averages

For information regarding the construction of Madison’s Lumber Prices Index (species mix, weighed averages) please go here: https://madisonsreport.com/madisons-lumber-prices-index-a-powerful-tool-for-data-driven-decision-making/

As autumn dawned Canadian purveyors of Western S-P-F lumber described a confused market. Buyers continued to rely on just-in-time purchasing, while flexible secondary suppliers and a smooth transportation pipeline encouraged them to stick to that strategy. Players warned their charges about sitting on lean field inventories as cold weather and potential supply and

logistical disruptions loom. For their part, Canadian sawmills reported a mixed bag of pricing and availability, with several standard grade items showing softness while prices of #3/Utility firmed up.

Order files at producers were anywhere from prompt to two weeks out, sawmill- and item-dependent.

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

* Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

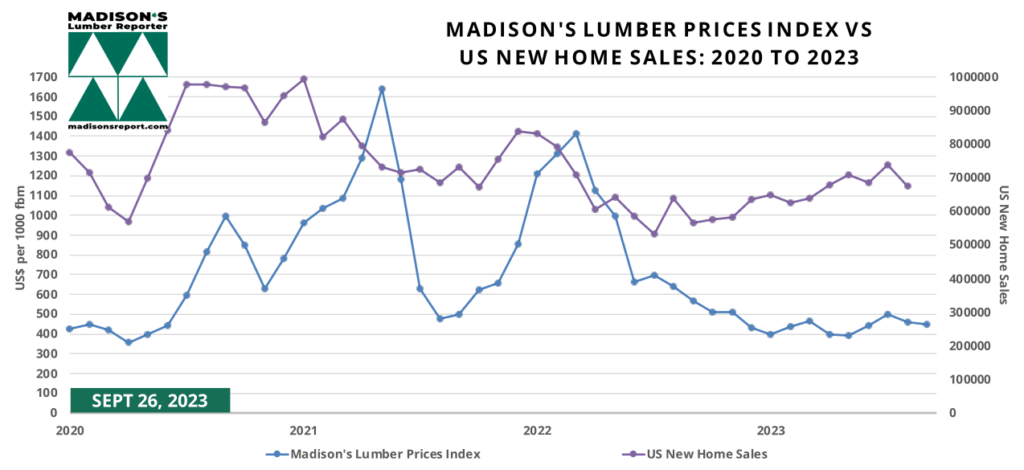

The U.S. Census Bureau and the US Department of Housing and Urban Development released September 26 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

Trending somewhat upward after big drops last year, sales of new single-family homes in the US fell -9%, to 675,000 units in August 2023, from July’s 739,000.

This is up +6% compared to August 2022 when it was 638,000 units.

US NEW Home Sales August & Madison’s Lumber Prices Index September: 2023

At the sales pace in August, it would take a quite lengthy 7.8 months to clear the supply of new houses on the market. There was a stable 436,000 new homes on the market at the end of last month. Houses under construction made up 44% of inventory, with those yet to be started accounting for 17%.

The median sales price of a new home in August was almost flat, at US$430,300,

compared to US$436,600 in July, and compared to one year ago when it was $440,300.

As for those lumber prices, compared to the same week last year, when it was US$520 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending September 22, 2023 was down by -$104, or -20%. Compared to two years ago when it was $480, that week’s price is down by -$64, or -13%.

Madison’s Western S-P-F 2×4 Lumber Prices: Sept 2023