US homebuilding bounced back in September 2023, after dropping in August to the lowest levels since 2020 as mortgage rates climbed.

Despite elevated mortgage rates averaging above 7%, single-family starts posted a gain in September, according to the National Association of Home Builders, which says more buyers are turning to new homes because of a dearth of inventory in the resale market.

NAHB Chief Economist Robert Dietz said, “Despite ongoing challenges in the market, the housing deficit of resale inventory continues to provide some market support for builders. Because of a lack of existing homes in the marketplace, 31% of homes available for sale in August were new construction.

This compares with a historical average in the 12-14% range.” The number of apartments under construction is near 1 million units and will be falling in the months ahead, predicts the NAHB.

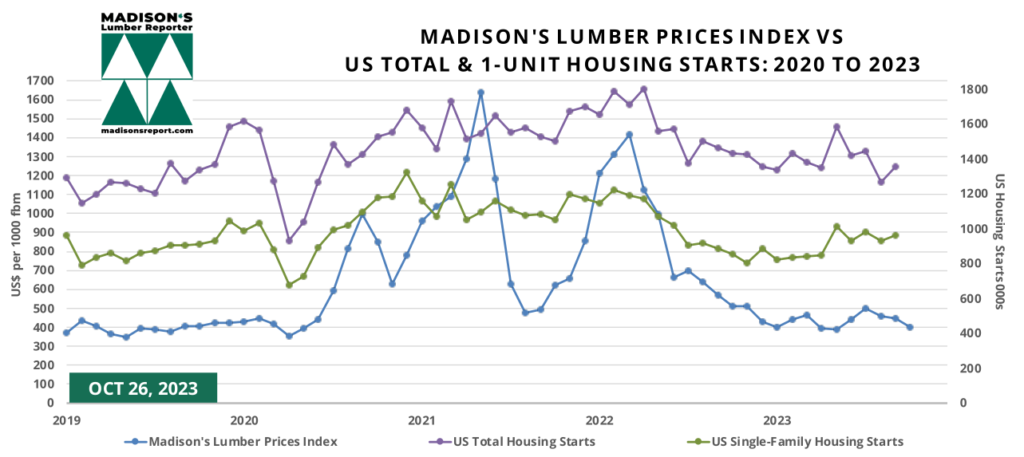

The interest rate increases of mid-2022 having served their purpose, September 2023 total housing starts in the US rebounded from consistent drops over the past year, up by +7% from the previous month, to 1.358 million units, compared to the 1.269 million units reported for August 2023, and were down -12% from the September 2022 rate of 1.463 million units.

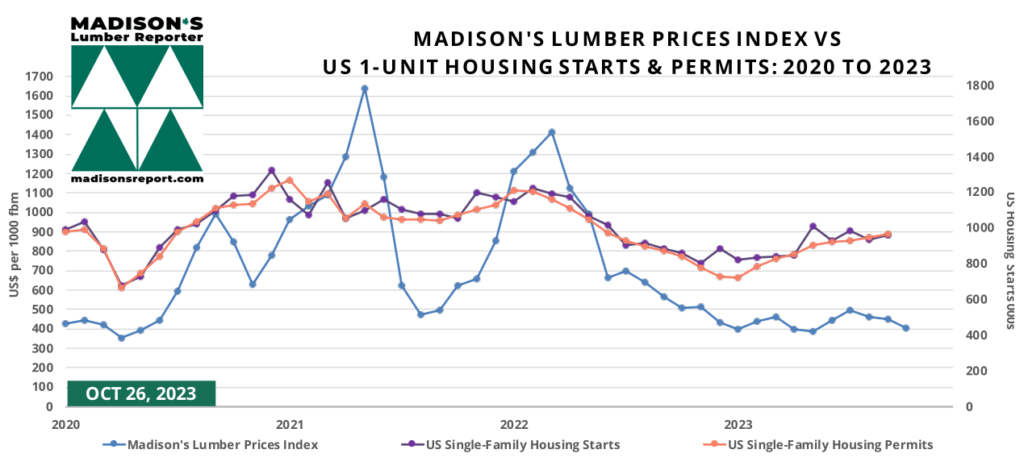

Madison’s Lumber Prices Index Sept & US Housing Permits Aug: 2023

Building permits meanwhile, as an indicator of construction activity to come, showed a decline as is the normal seasonal cycle for winter, down -4%, at 1.473 million units, from the August rate of 1.541 million. This is more than +1% above the September 2022 rate of 1.588 million. These permits will eventually become starts and will help to underpin residential construction.

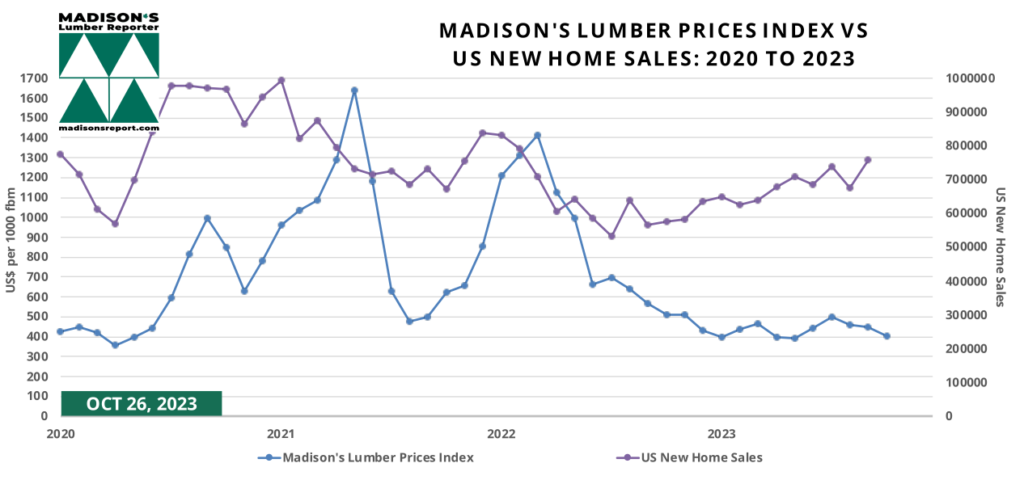

At the same time, the Madison’s Lumber Prices Index for the week ending October 20, 2023 was US$402 mfbm. This is down by -2%, or -$9, from the previous week when it was US$411.

Returning to historically more “normal” levels, housing completions rose by more than +5% from August, to an estimated annual rate of 998,000 housing units.

Units under construction continued to remain high, at 1.676 million units. Of those, 674,000 were single-family homes.

August starts of single-family housing, the largest share of the market and construction method which uses the most wood, also increased, up by more than +3% to a rate of 963,000 units, from 933,000 units in August.

Single-family authorizations were at 965,000 units, which is almost +2% above the August figure of 948,000 units.

Building permits are generally submitted two months before the home building is begun, so this data is as indicator of November construction activity.

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales. Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

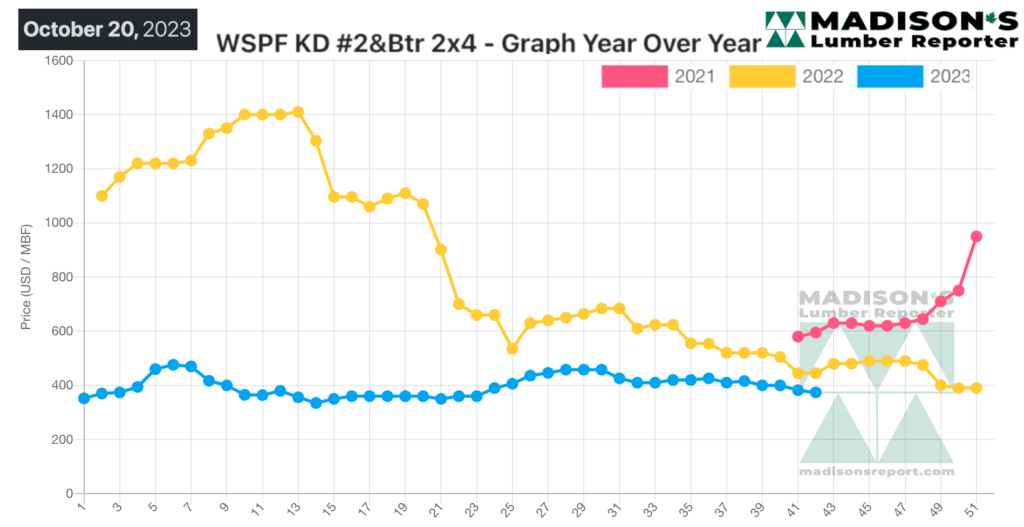

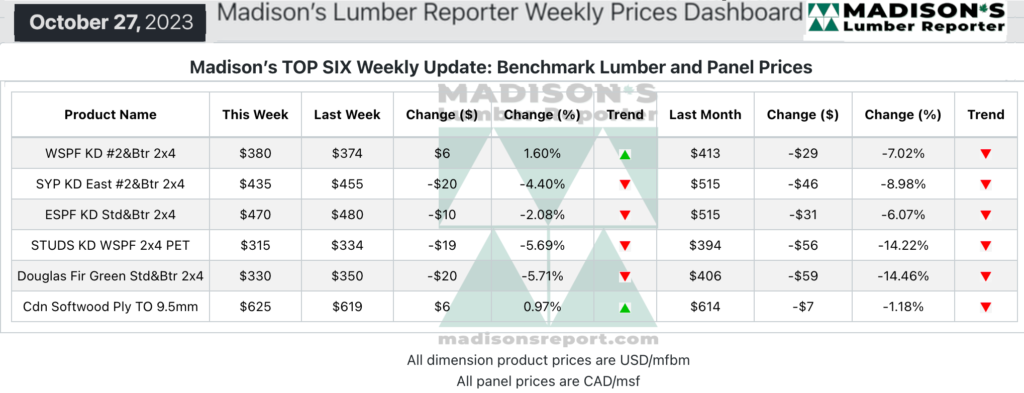

Looking at lumber prices, in the week ending October 20, 2023, the price of benchmark softwood lumber commodity Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$374 mfbm, which is down by -$8, or -12%, compared to the previous week when it was $382, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$39, or -9%, from to one month ago when it was $413.

Western S-P-F traders in the United States noted that sawmills drew a line in the sand, especially regarding what they were willing to entertain in terms of counters. While some buyers backed off, accepting this might be the price bottom, plenty others continued to run their meagre field inventories down to bare pavement rather than capitulate. Order files at sawmills slowly stretched into November, making the waiting game a less appealing course of action.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Historical Averages

For information regarding the construction of Madison’s Lumber Prices Index (species mix, weighed averages) please go here: https://madisonsreport.com/madisons-lumber-prices-index-a-powerful-tool-for-data-driven-decision-making/

Demand continued to limp along for Western S-P-F lumber, according to suppliers in Western Canada. Sawmills reported strong counter offers requiring review on a case-by-case basis, with order files stuck at less than two weeks in most cases. Many players expected that this meandering pace of sales will persist for the rest of 2023, but stranger things have happened.

Takeaway in the field remained soft, as cooler weather further dampened overall demand. Buyers maintained lean field inventories and mostly covered their needs through the distribution network via LTL and mixed load orders. Eroding prices and weak sales increased chatter regarding potential curtailments to bring supply more in line with anemic demand.

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

* Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

The U.S. Census Bureau and the US Department of Housing and Urban Development released October 25 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

After a correction downward last month, sales of new single-family homes in the US continued their general climb upward of the past year, increasing more than +12%, to 759,000 units in September 2023, from 676,000 in August. This is up +40% compared to September 2022 when it was 567,000 units.

US NEW Home Sales SEPTEMBER & Madison’s Lumber Prices Index october: 2023

At the sales pace in August, it would take a close to the average 6.9 months to clear the supply of new houses on the market. There was a stable 435,000 new homes on the market at the end of last month. Houses under construction made up 46% of inventory, with those yet to be started accounting for 15%.

The median sales price of a new home in September dropped to US$418,800, compared to US$430,300

in July, and compared to one year ago when it was $477,700.

As for those lumber prices, compared to the same week last year, when it was US$445 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending October 20, 2023 was down by -$71, or -16%. Compared to two years ago when it was $595, that week’s price is down by -$221, or -37%.

Madison’s Western S-P-F 2×4 Lumber Prices: OCT 2023