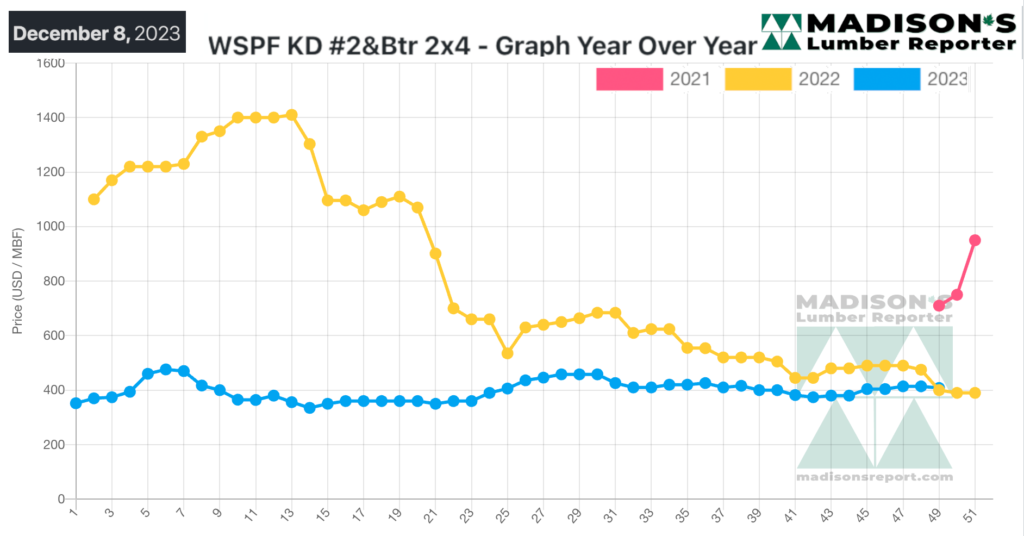

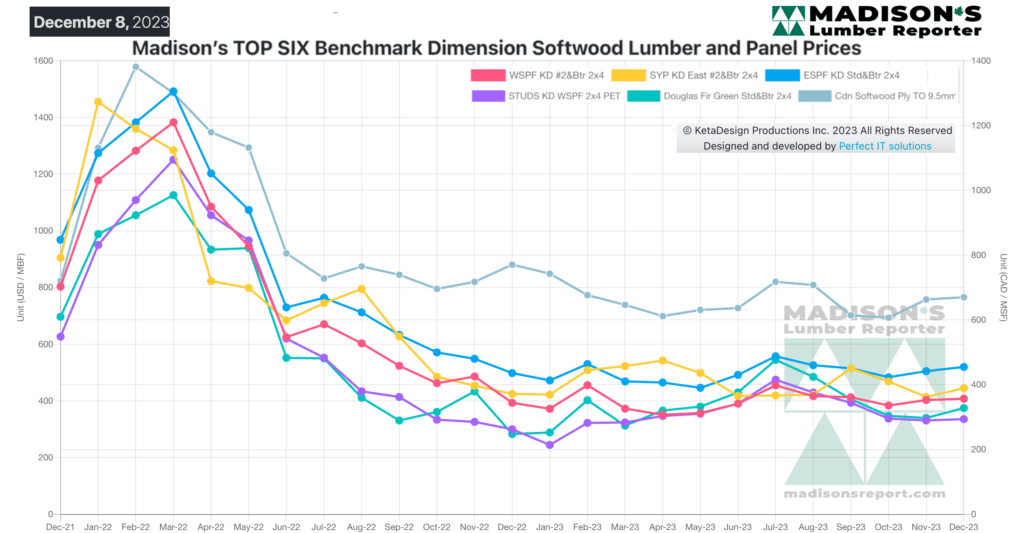

In the final weeks of this year, the full trendline for 2023 shows some real stability for North America construction framing softwood lumber prices. Especially in comparison to the previous couple of years.

Indeed, the weekly price of both benchmark Western S-P-F and Southern Yellow Pine East Side 2x4s landed almost exactly where they were one year ago. This gives industry the ability to better understand market conditions and to plan for the coming year.

For their part, customers — whether home builders or lumber retailers — continued to show reluctance to make purchases beyond immediate needs. After all the uncertainty of recent years, lumber buyers are concerned that prices might fall, thus have been holding off buying for inventory stocking.

The muted housing construction activity for the second half of this year also suggests caution in keeping large volumes of wood on hand. However, the discipline exhibited by sawmills across Canada and the US, to curtail when demand

was soft, has done a lot to keep the level of supply in balance with demand.

There is one more week of lumber price reporting from Madison’s for this year … our first publication date for subscribers in 2024 will be January 4. Many players felt this was the most balanced they’ve seen the market all year, with neither the supply or demand side able to exert much pressure one way or the other.

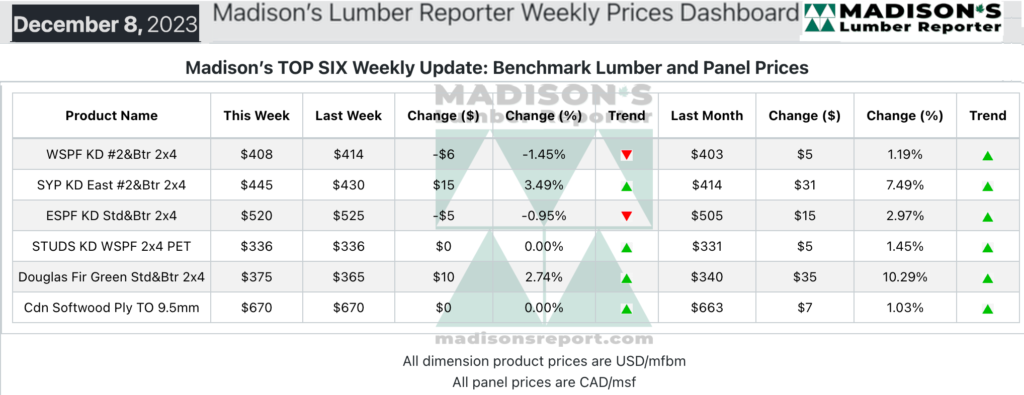

In the week ending December 8, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$408 mfbm. This is down by -$6, or -1%, compared to the previous week when it was $414, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$5, or +1%, from one month ago when it was $403.

Demand was flat in standard dimension and panel products, while unexpected strong pockets of sales were reported in Hem/Fir markets.

The tone of US Western S-P-F sales was similar to the previous week as prices, demand, and supply were all flat. Business meandered along at a seasonally-appropriate pace, with buyers poking around the distribution network to find what near-term coverage they needed to get them through to year-end.

The sentiment heading into the holiday break was somewhat positive due to a combination of heavy inquiry for 1Q 2024 orders, as well as economic indicators that appeared to be stabilizing. Many traders advised their charges to secure early-2024 shipments as they said January is a big month for lumber sales.

Demand for Western S-P-F lumber saw little change from the previous week according to Western Canadian suppliers. Sawmill asking prices were flat almost across the board, with a few exceptions landing on either side of the previous week’s levels.

Wholesalers and distributors reported a better mix of availability from the sawmills; albeit sporadically and in small volume chunks. Buyers continued to replenish sparingly as they had most of their needs covered for the remainder of December.

No news was good news in the realm of transportation.

Sales and inquiry of Eastern S-P-F commodities was hit-and-miss. With most sawmill asking prices meandering around the previous week’s levels, many buyers couldn’t decide whether they should jump in and cover their needs for the remainder of 2023, or wait and see whether they could snag some discounts before the holiday break. Producers traded on price in order to motivate vacillating buyers, with some already taking orders for after they return from holidays.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages