After a minor boost in recent weeks, toward the end of October North American softwood lumber prices began their usual annual seasonal drop. Customers, whether retailers or end-users, continued to make purchases for immediate needs only, keeping their inventories quite lean indeed.

This story originally appears in the latest print issue of Canadian Forest Industries magazine, here: https://mydigitalpublication.com/publication/?m=853&i=808134&p=24&ver=html5

For their part, sawmills kept production volumes tight to stay in line with weakening demand as this winter season truly comes on. After the volatility of the previous two years, these more normal price fluctuations were welcome by industry players.

Now that the previously unimaginable price highs are relegated to history, builders and lumber producers are better able to gauge what might come in 2024.

The price high for Western S-P-F 2x4s this year was US$476 mfbm in the week of February 9, then was US$458 for most of July; while the low was in the beginning of January at US$370, which is very close to

the current price. This more usual price swing of approximately $100 mfbm throughout the year is much closer to what sellers and customers were accustomed to in the past.

This means they can more confidently make their business plans for the near future, specifically spring building season 2024.

The US Thanksgiving long weekend usually marks the beginning of true slowdown for construction activity across the continent, thus for lumber manufacturing as well. Looking back over this year’s rather stable trendline for price changes, the expectation for next year is a continuation of this more “normal” cycle.

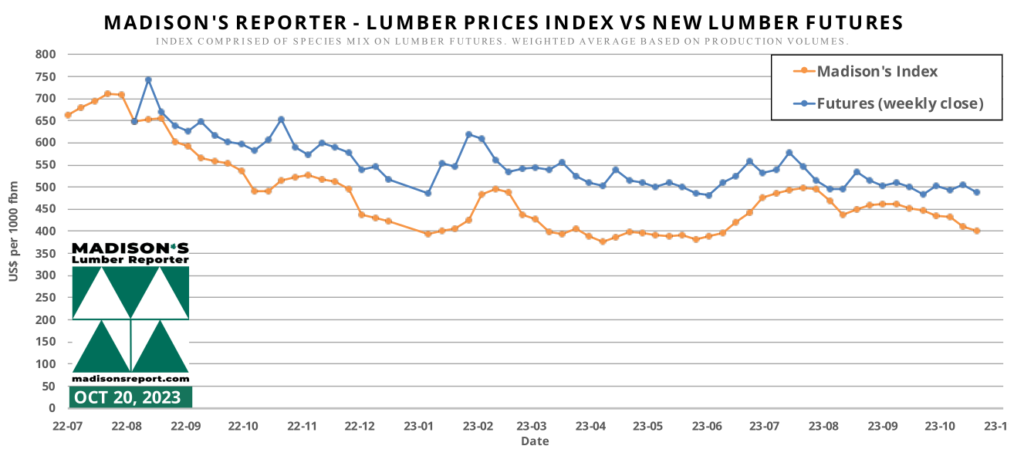

The Madison’s Lumber Prices Index for the week ending October 20, 2023 was US$402 mfbm

This is down by -2%, or -$9, from the previous week when it was US$411.

The new formulation having existed for 14 months, Softwood Lumber Futures, as traded on the Chicago Mercantile Exchange, dropped from a high of US$578 mfbm in mid-July to US$488 toward the end of October.

After spiking to unsustainable highs during the disruptions to society in the past couple of years, US housing starts trended further downward in August 2023. Permits for authorizations of new home building increased, however. Demand for new construction has been boosted by an ongoing acute shortage of previously owned homes on the market.

Realtors estimate that housing starts and completion rates need to be in a range of 1.5 million to 1.6 million units per month to bridge this inventory gap. Expectations among construction industry insiders and financial lenders alike is that single-family construction starts could rebound in the coming months, if builders are able to keep their skilled labour.

Now that the severe volatility and series of extreme circumstances are in the past, the construction and the forest products industries can both use the sales volumes and price data of 2023 to better make their business plans for next year.

As the underlying dynamics of the housing market unfolds – not enough homes for the demographic currently reaching home-buying age – expectations are for an uplift in home building next year.

Given the ongoing slowdowns and curtailments at sawmills over the past more than one year, there is enough lumber manufacturing capacity able to come online to serve this need.